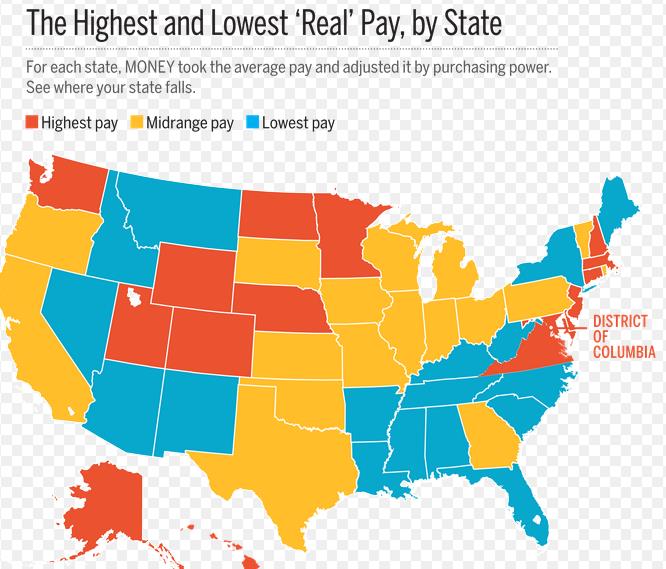

After graduating from the mainland of the United States, he walked towards the society after graduation, or entered the university as a teaching position. Or enter the industry as a scientist or engineer, with a starting salary of 50,000 to 70,000 US dollars. Generally, 80,000 to 10 10,000 US dollars after working some more. Students who have graduated from the United States after graduating from international students, an annual income of $ 100,000 is a very common income, but it is rare than more than $ 150,000. The income of $ 100,000 is a typical middle -class income, which is at the middle level of the middle class. If you browse the end of the world, you often see the international students in this income section \"Tucao\". Of course, there is no objective standard for life, mainly depending on the mentality, but the financial state of the middle -class person refracted in it is universal.

] A netizen lives in Queens in New York, with an annual salary of US $ 100,000, claiming to live a life of pigs and dogs. His monthly income is $ 9,000, with a monthly income tax of 2,200 US dollars, a medical insurance self -payment amount of 300 US dollars, a house mortgage of $ 2,500, a real estate tax of $ 400, a house insurance $ 100, a water and electricity fee of 400 US dollars, a subway and commuting commuting A total of $ 300 of train tickets,

Monthly paid $ 350, car insurance $ 120, gasoline fee of $ 240, telephone fee of $ 100, mobile phone fee of $ 150, cable TV and online fees of $ 100, children's school bus fees, children's school bus fees $ 240, $ 200 in Chinese lessons. The fixed expenditure per month has reached $ 7,700, and only the remaining $ 1,300 for the whole family to eat and wear. \"\". There are also couples working, and their income is relatively high. A netizen's annual income was 165,000 US dollars, which was at the top 6.5%of Americans and lived tightly.

Because it belongs to high income, its tax rate is high, tax taxes account for 24%of household income, of which 12%of the federal tax and about 5%of the state tax. The rest is social insurance tax. Supplementary pensions accounted for 20%of revenue, and medical insurance accounted for 4%. After these two large expenditures are the costs and water of houses and car nourishment, waterElectric gas and transportation costs. Because two people work in this family, they need two cars, and they invest in housing and children's education relatively much. Therefore, there are few balances every year. Of course, their pension payments have a lot of guarantee, which means that they have better guarantees after retirement. The above two cases of \"Tucao\" show that no matter where you live, no matter how income, no additional income, the daily life of the first generation of immigrants at home is probably this: It needs to be quantified as a place of life. In fact, this also represents the living conditions of most people.

But the United States levies heritage tax, and at the same time, there are few gray income from all walks of life, which determines the relatively fairness of the people's starting point. On this basis, you may wish to look at the middle class of the mainland and their dilemma. List the average household income in the United States:

No. 2: San Francisco, California, Family average income: $ 74,922

3rd: Boston Family Increase: 71,738 USD [ 123]

No. 4: Mary in Maryland Baltimore, the average family income: $ 66,970

5th place: Minnespois, Minnesota Prefecture , Family average income: $ 66,282

6th place: Washington State Seattle City, family average income: $ 65,677 No. 7: New York, New York State, Family average income: $ 63,982

No. 8: Denver, Colorado, Family average income: $ 61,453

9th place: San Diego California, family average income: $ 74,922

No. 10: Pennsylvania, Philadelphia, Family, average family income: $ 60,330

] Here, assuming such a city white -collar worker and his family, a typical technology or management position, the middle level of the enterprise, of course, is not state -owned enterprise or a civil servant, there is no civil servant. There is no civil servant. There is no civil servant. Invisible income.

The couple have a pretty decent income and living state. The monthly salary of the two is over 10,000, which is a group that must declare every year. Living in the suburbs of first -tier cities, it has a set of housing worth 2 million to 3 million yuan (dependent on RMB, the same below), which is only purchased in the past two years, and there is a baby to be fed. Professionals such as the center of society can also be called the middle class in the rise. But their quality of life can only be at the same level as overseas middle class. It took three hours to get off work for tens of kilometers a day; decent jobs were inseparable from decent costumes and a large amount of expenses; the price of lunch rose straight, and colleagues still used to be AA in the hotel in the restaurant. System solution, now find Canteen.

The maximum expenditure of the family moonlight every month is a mortgage, which is the child's support and educational expenses that make the family's finance stretched. There are too many samples such as the mainland. It seems that you don't have to sit in the seat, you can calculate their income and expenditure with only a computer. The taxation bureau mentioned two tax thresholds, and the tax burden of white -collar workers seemed to be minimal. Borrowing a five -insurance and one -gold computer on the Internet. If the family lives in Beijing and the income before the tax is exactly 10,000 yuan, the part of the individual in the five insurances and one gold is 2223 yuan. For some tax -free income, he paid only 322.70 yuan for , and 7454.30 yuan after tax. For this family, assuming a monthly salary of a monthly salary of 10,000 yuan, the personal income tax borne by the family is 645.40 yuan. Compared with overseas countries with income tax as the main tax subject, 3%of the tax burden can be described as few.

It can also be found through five insurance and one -gold computer that the unit pays 4,410 yuan, which is nearly twice the personal payment. When an enterprise issued a monthly salary for employees, it actually paid 14,400 yuan, which means that employees' salary increase potential is limited. A large amount of income of such a family is on the mortgage. Because of the lack of accumulation, they usually borrow a considerable mortgage from the bank when they buy a house. Yuan. Fortunately, both of them have provident funds, and the provident fund is duty -free. Half of them come from themselves, half from the enterprise, which is a state of compulsory benefits. The two people's salary of 20,000 yuan, the monthly provident fund is 4,800 yuan, which can help pay a small and a half loan. But after deducting this part, a monthly repayment of 6,428 yuan is still withdrawn from the salary income after tax. The two were less than 15,000 yuan after tax.The next is 8480 yuan. This money has to eat, keep a car, and buy milk powder for children. Without the help of the elderly, the two employees' families have to invite a nanny. The price of employment is even more

High. And \"no more bitter children can be bitter\", the cost of eating foreign milk powder for a month is approximately 2,000 yuan. The problem comes, and the income of more than 8,000 yuan cannot meet such overhead. Such a small family either \"active\" when buying a house; either he is old, including paying the savings of parents on the down payment of buying a house, or asking your parents to help, or Simply \"父 rice in his parents' house.

The problem of a small family becomes the trouble of a big family. So, a big family, the three generations of grandchildren seemed to be able to live on the most basic consumption level without room for improvement. On the surface, this is a personal choice of a family, and the government has not received some benefits from their loan behavior. But in many countries, the government has never collected taxes in the links of building a house, but levied property tax. The advantage of the property tax is that the owner is not a one -time payment, but a long stream of water, reducing huge pressure at one time.

On the other hand, the real estate tax is accompanied by the market, and the buyers at any price are relatively fair. In the mainland, early buyers have undoubtedly obtained a huge \"discount\", thereby increasing \"some\" and \"some\" and \"some\" and \"some\" No \"two types of people income gap. May wish to look at the tax burden of mainland middle -class families due to real estate from the perspective of taxation. Among the costs of real estate projects, land costs and various taxes account for about 40%to 55%of house prices, which means that half of the expenses have been taken away by the government. Of course, the government also has the cost. Let's conservatively estimate that government share accounts for 1/3 of the price of housing. Housing worth 2 million yuan, of which 670,000 yuan flows to the government, this money can be regarded as an additional tax burden other than a small family except for individual taxes. If 670,000 yuan is distributed in 20 years, the tax burden of more than 3,000 yuan per month will increase the tax burden of household tax suddenly by 15%, and then calculate the personal income tax, the tax burden exceeds 18%. Someone will argue that our land has 70 years of use and should be split in 70 years. Slowly, in addition to the one -time land transfer fee, the government has repeatedly tentaged the property tax collection, which means that the 70 -year right to use is a pretty illusory concept. With these 70 years of use, House ownerMay pay

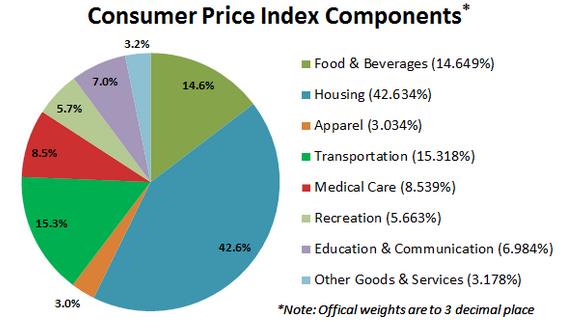

additional tax burden. In the United States, this family can correspond to middle -class families with an annual income of 50,000 to 100,000 US dollars. The average tax burden on this group of families is 26%to 27%. But the US tax system is mainly income tax, and the proportion of circulation taxes that are attached to property, capital income and attached to goods in addition to income tax are small. It is the sum of all taxes. But the taxation of the mainland is mainly indirect tax, especially the value -added tax and business tax in the circulation tax account for nearly half of the total taxes, which means that consumers have 17%or 13%of value -added each time they are shopping. The tax is paid to the Treasury via the merchant .

If the family spent 100,000 yuan a year, it would pay 13,000 to 17,000 yuan in value -added tax. Of course, if you buy food in a small store, the value -added tax is calculated at 6%of the price of the product. Value -added tax is approved by total turnover. The family that assumes that the family has carried out too much mortgage, and the expenses that can be used for consumption in one month are full of more than 8,000 yuan. The value -added tax paid is estimated to be 5%to 7%of the family's total income. Recently, the white -collar workers are keen to buy online shopping, and it seems to have escaped the value -added tax. In fact, it only reduces the value -added tax of the retail part. Essence

Assuming that the family's circulation tax burden is 6%, which has increased from 18%of the previous article. Its family tax burden has exceeded 24%. A U.S. middle -class family The level of tax burden. But there are various taxes such as consumption tax and tariffs outside the value -added tax, which is hidden in the price of the goods. In addition, the 3%operating tax for real estate trading and 10%of the vehicle purchase tax required for buying private cars involves 10%of the amount of vehicle purchase tax. From the yuan to the upper 100,000 yuan, It constitutes a heavy burden on the income of ordinary workers.

In addition, the tax burden on this mainland's middle -class families will exceed 30%, which is still conservative estimation. Compared with the bills of middle -class people in the two places, we can find three main problems: First, the house prices in the mainland are too high. The new US immigrants purchased houses ranging from their income level of 300,000 to 500,000 US dollars. Although they are the upper limit of their own payment levels, they do not affect normal living conditions and do not drag their families. In the first -tier cities in the mainland, \"New Immigrants\" could not find a house at a reasonable level of payment, and could only buy a house that had been purchased by family or other types of consumption. Second, the tax burden is unfair.123] Overseas shopping overseas, domestic wealthy people in the mainland can save a lot of import taxes. At the same time, it eliminates the value -added tax of domestic shopping, but white -collar workers have to bear the accumulation of omnipotent value -added tax.

Third is the regulation of taxation. In developed countries, the tax is high, and the level of welfare is also high. The revenue adjustment system allows the rich to pay more taxes, and the poor may pay taxes on less taxes, so that social wealth is further distributed fairly. For those with low income, such as college tuition, children's heads and home purchase loans can be refunded. Family governments who have difficulty raising children also regularly pay \"milk powder gold\" or \"nanny allowances\". We are here for mutual assistance within the family.

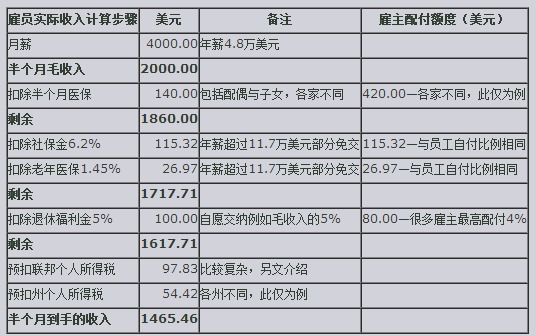

How much does the American income be deducted?

Example 1: Single 50,000 US dollars, standard deduction: Personal Exemption $ 3,800. : 50000-3800-5950 \u003d 40250, check the table (single) to get a tax payment of $ 6,181.

Example 2: The couple, neither of the two children are less than 17 years old.

The couple 50,000 US dollars, standard deduction: Personal Exemption $ 3,800 (by 4). Standard Deduction Single $ 5,950 (by 2)

Tax revenue: 50000-4*3800-2*5950 \u003d 22900, checking the table (the marriage of the married union) received a tax payment of $ 2,589. Children under the age of 17 have a return of $ 1,000, 2589-2000 \u003d 589 US dollars.

The couple, neither of the two children are less than 17 years old, and pay $ 589.

The above is simplified, investment income, disability, and many other factors.

Example 3:

Annual revenue of 300,000 single, tax taxes of about 90,000 US dollars.

\u0026 nbsp;

Next to see a set of data, there is still a reference meaning:

1. Average American total family income: 71,258 US dollar

It is necessary to point out that $ 71,258 is based on the 2015 salary data of the National Taxation Bureau (IRS), which is the latest number that can be obtained from the bureau.according to. The median income of Americans increased by about 4%in 2016, so it can be assumed that the average household income in 2016 was about $ 74,000. 2. U.S. average family debt arrears: $ 132,529

This includes all credit cards, mortgage loans, car loans, student loans and other types of other types of debt. The average family arrears holding mortgage loans were US $ 172,806, the average household arrears of Credit Card Balance were $ 16,061, and the average family loan of car loans was $ 28,535. 3. The average charitable donation of Americans: $ 5,491 in 2015

According to the preliminary data of the 2015 tax year of the National Taxation Bureau, the taxpayer's office The average amount of donations is nearly $ 5,500. But there are two things worth noting: first, this only includes a taxpayer who has made \"Itemized Deductions); second, the amount of charity donation has a lot to do with income. For example, the average donated amount of income from 5 to 100,000 US dollars is $ 3,244, and the corresponding value corresponding to 250,000 or more people is as high as US $ 21,769. 4. The average FICO credit score of Americans: 700 points

According to the latest \"FICO SCORE HIGH ACHIEVERS STUDY\", the average American of Americans The FICO credit score has increased by 5 points since 2015 to 700 points. 5. 401 (K) Planning account plan balance: 96,288 US dollars

It is important to note that this value is an overall average, different ages, different ages There should be different amounts of money in the paragraph.

In addition, the median deposit of 401 (K) is very different from the average of the deposit. In the report of the \"2016 Americans deposited in 2016\" of investment company Vanguard, the average and medium number of deposits of 401 (K) deposits at different ages are listed. 6. Personal average deposit ratio: 5.5%

Compared with 1.9%in 2005, the current personal average deposit rate has greatly increased. This includes retirement savings and various emergency savings, but it is probably not enough for ordinary people. The deposit ratio proposed by most experts is at least 10%to 15%of the income,Excluding pension plans paid for employees for employees. 7. Only 18 % of Americans actively participate in personal retirement accounts

If the employer provides you with a good retirement plan, such as 401 (K (K (K (K (K (K ) Public pension account plan, you do not use personal retirement account (IRA). However, 25%of those who do not have a personal retirement account said they did not understand these accounts at all, and 46%said they had no money to deposit. 8. The average American income tax refund in 2016: 2,860 US dollars

In 2016, more than 70 % of the total tax refund of Americans exceeded 317 billion US dollars, These numbers should not change much in 2017 because there are not many major tax changes last year.

According to a survey of Gobankinglates, in 2017, 79 % of those who are expected to obtain tax refund stated that they may deposit or use it to use it with it Come to repay the debt.

11%said they would use tax refund for vacations, and 5%said they would pay for large -scale purchases with this money, such as housing or cars. 9. The average valid federal income tax rate paid by Americans: 13.5%

In addition, the average American pays 9.9%of the state and local income income tax income tax Social Security Tax is 3.3 % and medical insurance is 1.45 %.

Generally speaking, the effective tax rate based on income is above 28%. 10. The average social security retirement benefits of Americans: $ 1,363 per month

In January 2017, the average retired worker benefits are monthly monthly $ 1,363, which is $ 16,356 per year. 21 % of the married couples and 43 % of single retirees rely on social security gold as almost all (90 % or more) income.

#