This time we introduced a service for the registration of European VAT

VAT experts specialize in VAT and customs issues in Europe and some non -European countries. I have 6 years of VAT experience. I will provide you with all the necessary information about all VAT and customs issues and your questions about any EU tax management.

I will also provide you with a VAT registration process of A-Z to provide you with all the necessary documents required by different tax bureaus to obtain effective EU VAT N °.

If you are not established in the EU, I will also help you get the EORI number so that you can transport the goods to the EU or ship out from the EU.

If you are a Amazon seller, welcome you very much:)

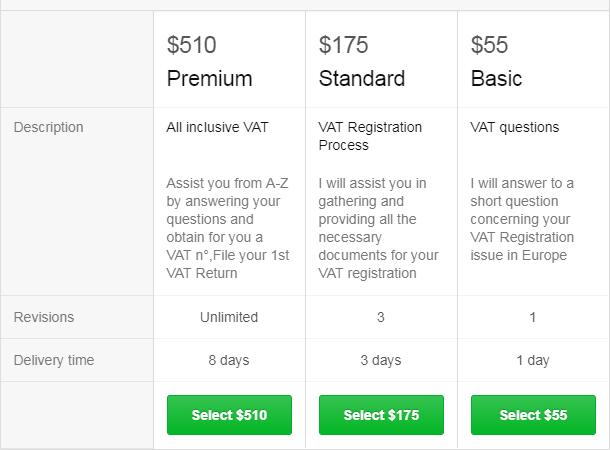

From 55 US dollars, it provides some VAT you want to ask Consultation, and if you want to help you help you register and provide some documents, you only need $ 175 to help you get it. If you want to assist the whole process, you need 510 US dollars.

Click to enter the VAT service

\u0026 nbsp;

Service 2: British VAT registration:

] I am a qualified management accountant, with more than 30 years of business experience, and I will help you at any time. If you sell online online markets online to British consumers through online markets such as Amazon or EBAY, you may need to register British VAT.

In fact, you may have received an e -mail from the platform provider, asking you to provide effective value -added tax registration numbers. If you cannot provide it, your account may be suspended.