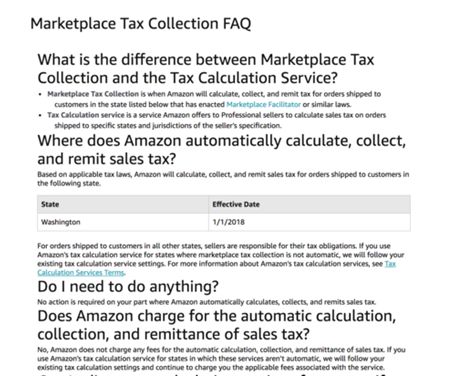

So why did Amazon's third -party sellers collect taxes in Washington? This starts from the new law of Washington earlier this year. On January 1st this year, the Washington State Council passed the Marketplace Facilitator Law. In the new bill, it requires a certain standard of online malls, such as Amazon, and must replace third -party sellers on the platform to use its platform. The business tax is closed.

\u0026 nbsp;

Surprisingly, Mike Dillon, a tax lawyer who came to Dillon tax consultation, said that the new bill actually did not indicate that Amazon had taxes on behalf of the FBA sellers. The reason why Amazon takes such behaviors is that Amazon has reached relevant content agreements with Washington at other times.

\u0026 nbsp;

On the question of \"what kind of influence of ordinary FBA sellers will be affected\", Mike Dillon said that \"it can be said to be as different as ever, or it can be said to be completely different.\" This answer is a bit vague for us, so I am here to refine it.

\u0026 nbsp;

First of all, it is a change. Now that Amazon has stated that the content of sales in the Washington area will be completed by them, so for FBA sellers, from this year, there is no need to set the content of the business tax at the seller center. In addition, FBA sellers with tax relations with Washington still need to submit an integrated Washington business tax tax declaration form or Washington commercial and professional tax declaration form, but there may be small changes in the specific content. According to the Washington Taxation Bureau, Amazon's taxes on behalf of the tax reduction will be included in the sales tax of Washington. More precisely, tax reporters need to fill in the part of Amazon's collection into the \"other\" subtraction, and it must also indicate that the subtraction is \"taxed by a third party\". Except for the change of this piece, any link of the FBA seller in Washington will not be affected, that is, how to prepare stocks or how to prepare, and how to ship the goods.

\u0026 nbsp;

Tax associations still exist on most sellers. The Washington Taxation Agency's statement shows that sellers who are stored in Washington State are still regarded as having business tax in Washington. In other words, if the seller has inventory in Washington's warehouse, or because of other reasons, it is related to Washington's business and professional tax, then a Washington sales license must be registered to ensure that the tax work is positive.Frequent. In addition to the Amazon platform, there are other sellers with other sales channels or warehousing channels, in the new model, taxation work will become complicated. If some sellers are selling on Amazon, they still have their own stores on WOO malls. For such sellers, because they have goods in Amazon's Washington Branch Center, they have a tax connection with Washington. Therefore, Amazon Based on the sales of the seller on the Amazon platform, it will collect business taxes on behalf of the Amazon platform, and sales outside the Amazon platform need to add taxes to consumers in Washington.

\u0026 nbsp;

Sellers who have tax associated with Washington still need to report and pay Washington Commercial and occupational taxes. The proportion of taxation of Washington Commercial and Vocational Tax is quite large, almost half of the sales in Washington. Tax reporters need to pay this part of the tax while submitting the tax declaration form. Overseas sellers are also treated the same. States in the United States are consistent with the requirements of overseas sellers and state outsses in terms of taxation. If the seller is located outside the United States and is sold on Amazon, then Amazon will also collect the business tax in Washington, but these sellers need to obtain an additional Washington sales license. Washington Commercial and Vocational Tax also has Washington Business Tax.

\u0026nbsp;

税务方面的变化不仅仅发生在华盛顿,假如我们放眼全美,会发现一些其他州也通过了和《市场促进法》类似的法律,而更多The area is discussing whether to pass similar laws. Because the tax law of the consumption tax can be determined at the state law level, the states may be slightly different in how to charge this part of the tax and fees.

\u0026 nbsp;

For example, South Carolina is accusing Amazon for taxation, and said that e -commerce giants have always been arrears of tax payment; The sales of FBA sellers are transferred to the authorities in order to collect taxes and fees that have not been paid in the past. California issued a notice to a large number of Amazon sellers in September last year, asking them to prove that they had obtained business sales permits when they conducted Amazon sales activities.