Just a few days ago, Amazon's market value exceeded 10 trillion US dollars, becoming the second company in the history of US stocks with a market value of over trillion Essence Amazon's stock price has risen by 600%over the past five years. And since 1926, Amazon has become the highest increase in the history of the U.S. stocks, an increase of more than 50,000%! Amazon's success is inseparable from its founder Bezos. Today, the ordinary people who are born in grass roots have become the richest man in the world with a value of more than $ 160 billion, more than 60%more than Bill Gatt.

Bezos

We often say that most people have lived in their lives Can't change the impact from native families. The children of the poor are often the poor, because their parents do not pay enough attention to education, and they cannot give their children more resources. Although we say that the United States always gives people the dream of \"American Dream\", in the United States, most people cannot change their social classes. We see many entrepreneurs, super rich, often come from middle -class families with good family. Whether it is Buffett, Munger, Bill Gates, and Zuckerberg. Wall Street Investment Bank and some big hedge funds have the blood of \"Jews\". Lehman (Lehman), Goldman, and Cohen are the surnames of the Jews.

And Amazon founder Jeff Bezos actually possessed the last name of a Cuban. Jeff Bezos's birthday was January 12, 1964 (now 54 years old). He was born in Albuquerque, a city in central New Mexico, and Bezos's mother Jacklyn Gise was 16 years old. Jeffrey Jorgensen, who is pregnant, is later Bezos. Ted Jorgensn, his biological father, worked at a retail store with an hourly salary of $ 1.25, and there was a problem of alcoholism. Therefore, when Bezos was 17 months old, his mother and his biological father Jossen divorced. In 1968, Jacqueline brought four -year -old Besos to marry the second husband, Maguel Bezos, Cuba immigrants, and Maggir adopted Besos. Jeffrey Bezos became Jeffrey Bezos.

If life is a \"ladder\" game, then Bezos's start is at the bottom of the ladder. He has no money and no resources. The stepfather and mother love him deeply, but cannot give him more social resourcesEssence Later experiences were like all cold gates, and Bessos was admitted by Princeton University in advance after graduating from high school in high school. The majors at the time were computer and electrical engineering. Before starting a business, Bezos was a senior vice president of Wall Street Queen Hedge Fund D.E. Shaw. He worked on Wall Street for 4 years. When he was leaving, he walked several times in Central Park and his boss. What Bezos saw at the time was that the Internet entered the outbreak period. Of course, at the beginning of entrepreneurship, no one could imagine that Besos eventually ruled the American e -commerce Internet and even became the richest people in the world!

As an entrepreneur, Bezos gives us the biggest revelation is its way of thinking. At a relatively early age, the establishment of correct or even mature thinking methods and values \u200b\u200bis often the biggest gap between ordinary people and great individuals. We saw those outstanding people sorted out very correct values \u200b\u200band kept persisting. In terms of investment, the greatest individual investor Buffett, when he was very young, established the concept of value investment, and did not use short -term huge profits as the investment goal. With time leverage, Buffett is already the most successful individual in the global investment community and the most wealth individual. On the first day of entrepreneurship, Bezos has a way of thinking ( Day One \"(can also be said to be values). Many entrepreneurs often lose themselves when they go to business. \"Don't forget the original intention\" is really important. At the beginning of the company's financial report every year, when the company's financial report will put on the vision of the first day of Amazon in 1997:

We want to share our most fundamental decision -making and management basis with you, All shareholders can confirm whether it is consistent with your investment concept.

- Unremittingly focusing on customers.

- Focus on becoming a long -term market leader, not short -term profitability or market response.

- Continuously measured projects and eliminated projects with poor returns, leaving only the best performance.

- It is bold to invest in projects that allow us to obtain the advantages of market leaders. Some projects can be successful, and some may not be. This is a valuable lesson for us.

- If you face the choice between optimizing reports and maximizing future cash flow, we choose the latter.

- When we make a bold choice, we will share with you the steps of our strategic thinking so that you can evaluate whether this is a rational long -term investment.

- Efforts to maintain a lean culture, we understand the importance of saving costs, especially in this line that is easy to clean.

- Continue recruitment of talents and geniuses, and using equity rather than cash to measure their competitiveness. We understand the importance of talents and must give them a sense of owner.

We dare not say that the above are the correct view of investment, but this is us.

Many people like to use the company's name to name their headquarters building. Such as Apple Building, Google Building, XX Bank Building and so on. The name of Amazon's headquarters is exactly Day One Tower! The company's values \u200b\u200bare not forgetting their original intentions. Bezos hopes that the team will always work with the spirit of an entrepreneur. Amazon is always at the beginning. When a reporter interviewed Buffett last year, he asked him who he saw the best entrepreneur during his decades of investment and economic cycle. Buffett said a name without hesitation: Jeff Bezos.

Amazon: A continuous innovative growth process

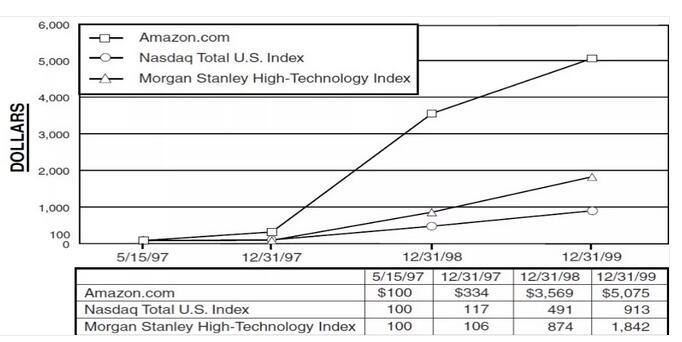

Amazon's initially did online books. At that time, there were two reasons. The first was that the book in the United States was very expensive. Another book was more than $ 40 or more. The other reason was that the book was a complete standard product. it's the same. In the first few years, Amazon's target competition company was the largest chain bookstore Barnes \u0026 amp; NOBLE. Basically, the products of the Amazon website were books, music and videos, and the content was almost the same as the bookstore. Amazon was not the largest e -commerce in the United States at that time, but another company called eBay. In 1997, Amazon was listed on a market value of $ 400 million. At that time, it was at the peak period of online stock bubbles. Amazon also became the first PC Internet bubble. The company's revenue from 1996 from 16 million US dollars to 1999 revenue exceeded 2.7 billion, an increase of 104 times. Correspondingly, the stock price has risen by 50 times. During the same period, the Nasdaq index rose 9 times, and the Morgan Steel high -tech index rose 18 times. Amazon was also the love stock of Solomon's star Internet analyst, Jack Grubman.

\u0026 nbsp;

Of course, after March 2000, the network stock bubble began to collapse. At that time, many stocks also declined more than 90%. Amazon is also not spared. The stock price fell from the highest $ 113 to $ 6 in 2002, a decline of more than 95%! For many entrepreneurs, this level of stock price plunge is unacceptable, and its self -confidence will suffer devastating blows. However, Amazon's founder Bezos was unhappy at all. At the moment of the stock price, Bezos is still looking for innovation in improving social efficiency. After the PC Internet bubble is shattered, most of the star stocks have never got up again. Even at that time, the leading stock AOL and Yahoo faded out of people's attention. Only Amazon and PriceLine survived and created a shocking collection.Breeding.

After the Internet bubble was shattered, although Amazon watched his stock price fall every day, he made a series of innovations and laid the foundation for the subsequent second rise. For example, in November 2000, Amazon launched the Marketplace service, turning itself from an online bookstore to a full -platform e -commerce, and starting competing with eBay. The company finally made the first profit in 2003. That year Amazon also did a great thing. It was a batch of publishers. Amazon began to publish e -books with its own copyright. From the perspective of profitability, the company's cost has been greatly reduced (from the role of a bookstore instead of a bookstore to the role of publisher replacement). In February 2005, Amazon launched a PRIME member service that has influenced huge influence today. The Prime members at the time could enjoy only two days of free express. But with the continuous expansion of Amazon's territory, Prime members can not only enjoy basic free express services, but also watch a lot of video content. After acquiring WHLE FOODS, Prime members can also enjoy free new retail free of charge On -site service. In 2006, Amazon also launched a huge AWS cloud service business on the company.

Of course, if we see Amazon's stock price at the time, it has been shocked from 2003 to 2007. These innovations brought huge cash flow to the company in the future, but at that time, the capital market did not see innovation that was really convincing, until 2007 launched the Kindle e -book reader. The launch of Kindle allowed Amazon to achieve a combination of software and hardware. The software is the soul, hardware as a carrier and channel. Today this model has been carried forward by many companies such as Apple and Xiaomi. Before Amazon launched Kindle, in fact, various e -books of various labels have come out. At that time, Sony's eBook reader was priced at only 300 US dollars. Panasonic full -color e -book readers were priced at only $ 340. But why did Amazon's Kindle launch greatly successful? We can also see Amazon's \"original ability\" in innovation. First of all, other readers needed personal computers to connect to the Internet in order to download books and music content, and then transfer to e -books through the USB interface. Kindle itself can download the content directly and cut off the umbilical cord of the e -book and computer. And at that time, Amazon had more than 88,000 e -books to provide downloads. The rich content was superimposed with innovative hardware products. Once launched, the competitors were eliminated. At that time, Amazon's opponent Barnes \u0026 amp; NOBLE also \"engraved the boat for sword\" launched its own e -reader NOOK. However, there is no software content behind it. NOOK has been destined to fail since birth. After experiencing a brief glory, it quickly entered the rhythm of sales significantly lower than expected. Just like a lot of standing in BeisuoLike the person on the opposite side, he left the stage of history as a loser.

The culture about Amazon's internal culture, and the closer executives of Bezos reflected that this is still a \"one word\" company. Bezos is even defined as tyrant by many people inside. He once told the employee that I paid your salary is not to let you oppose me. Many of the company's major decisions are formulated by Bosos alone. When he formulates direction, he often looks at three aspects: 1) the originality of this strategy. Amazon is not a \"Me TOO\" strategy. Others do this, I will follow; 2) scale effect. If it is successful, it must be a big business, not a small business; 3) a high return on investment. Even from the standards of Silicon Valley, the return on this matter is high enough.

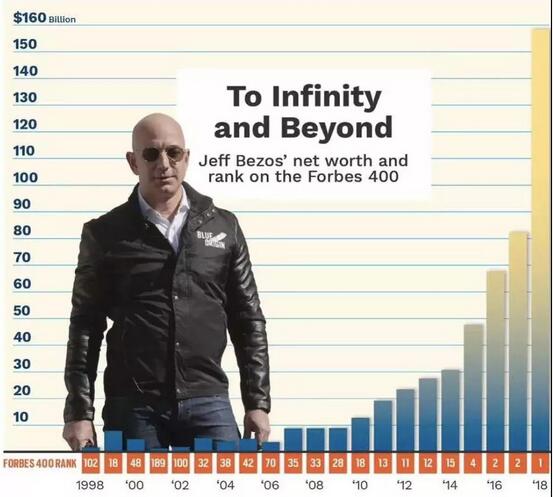

The Internet has a strong network effect. The larger a company, the larger the products of this company, and the better its products will be easier. The most typical is social software, including WeChat and Facebook all have this characteristic. And Amazon's network effect comes from its innovation capabilities, the greater the company, the stronger its innovation, and the faster the subversion of traditional industries. Before 2010, Amazon was a great company and was moved to almost all business school textbooks. From an online bookstore to an e -commerce platform, it is combined with hard and hard. Amazon's earliest competitors were Barnes \u0026 Amp; NOBLE, and Amazon's competitors later were retail giants Wal -Mart. After 2010, Amazon began accelerated innovation. AWS, Prime membership services, advertising services, and new retail models that have been promoted later have begun to explode. We can also see from the figure below that Besos's personal wealth also accelerates after 2010. \u0026 nbsp;

Amazon today seems to be omnipotent. In the retail industry, Amazon has eaten a lot of traditional retail in the past ten years. In the ten years from 2006 to 2016, the market value of traditional retail companies has shrunk sharply. SEARS Department Store plunged 96%, JC Penny fell 86%, Messi Department Store was cut, and Wal -Mart also fell 1%. And these falling market value all reached Amazon. At the beginning, the lowest race retail department store began to plummet, not only facing the impact of specialty stores, but also facing Amazon e -commerce with lower prices and better experience. The so -called Big Box Department Stores in the United States has become yesterday. Of course, this is just data in 2016. I did not expect that Amazon was more powerful 2 years later. Today Amazon's market value is already more than three times that of Wal -Mart, and it is 4 times that of Home DepotAbove, it was 50 times that of the US retail discount store Dollar Tree, and it was 10 times that of a member -made large supermarket COSCTO. During this period, a large number of retailers who have been closed by Amazon.

\u0026 nbsp;

\u0026 nbsp;

Amazon's AWS has also become the largest cloud computing service in the global market share, and AWS has a very high gross profit, almost contributed to most of Amazon's vast majority of Amazon. Business profits have also contributed nearly $ 300 billion to Amazon's market value. Today, cloud services are the fastest growing business in the global technology industry. We have analyzed with you that Microsoft's rearrassment and Adobe's 7 times increased from its transition from the cloud service. The boss of global cloud services is Amazon. It currently accounts for 44%of global cloud services, far exceeding Microsoft's 7%and 3%of Alibaba. These large traffic platforms can obtain a large amount of user data and traffic, so that cloud services, big data, and artificial intelligence algorithms can be done well. After all, these are business that requires high investment. And other tools of Internet companies cannot continue to do cloud services because there are no data.

\u0026 nbsp;

Amazon's omnipotent is reflected in today's \"new retail\". For example, the whole food (WHOLE FOODS) acquired by Amazon is hoping to bring e -commerce offline and use Amazon's powerful logistics system. As the leader of boutique supermarkets, Whole Foods tries to set up a positioning in consumers called health \u003d organic food \u003d Whole Foods. It had done this before being acquired by Amazon. However, the expensive price still scared a lot of users, and also faced competition from Sam \u0026#8217; S Club, COSCTO). After being acquired by Amazon, WHOLE FOODS has obvious competitive advantages, and its delivery service is very cost -effective for PRIME members. Amazon also began to cut through the boutique supermarket, hoping to subvert the traditional retail. Of course, Amazon is also going to subvert a larger industry: pharmaceutical e -commerce. Pharmaceutical e -commerce is currently monopolized by several large pharmacies represented by CVS. But the entire medical service accounts for 18%of the US GDP, which is a huge market.

Always live in the future

Great enterprise forever forever forever forever Live in the future. When Amazon obtained a beautiful quarterly or annual report, some people always wanted to congratulate Bezos. Bezos's answer was that this financial report actually sowed 3 years ago, or even earlier. Today, I want to work hard for the performance of 2021. Bezos has become the richest man in the world, and his company is successful. But Bezos still struggles on the front line and still lives on Day One. Every time heZhou would have a brainstorm with his colleagues. If he did not have a good idea, he would feel lost. Different Chinese companies have been labeled \"China Amazon\". The earliest is Dangdang, but today it is not a product at all to see Dangdang and Amazon. It is the earliest online bookstore of Amazon, but it does not have Amazon's soul, no new innovation power, but staying on a small piece of land in his own. When we look at a business, the core is the soul. Amazon is a company that always lives in the future. But this living in the future does not mean that the money of investors is burned every day and tried and error. All Amazon's innovation is based on the return of long -term cash flow, and it is also the essence of value investment. Bezos himself once said in a letter of shareholders: Why don't we pay attention to the growth of earnings per share like most people? The answer is simple. Profit cannot be directly transformed into cash flow. Stock value is the value of future cash flow, not just the present value of future profit. \"The picture below is the free cash flow data from Amazon from 2006 to 2015. Amazon's cognition still has the impression of its long -term non -profit in the past. In fact, the value of free cash flow created by Amazon has been increasing. In the past few years, with the rapid growth of these high gross profit income, such as advertising revenue, AWS income, Prime membership income, etc. The free cash flow has also completed a new leap! Therefore, when Basel is not only innovation, it is not just innovation, but also remembering the original intention, but also that it continues to create value for investors through innovation! 123]