How do you need to issue an invoice when selling in the EU.

Question 1: How to ask for European VAT numbers?

When you sell goods in Europe, you may need to charge VAT. If so, you will need to apply for a value -added tax registration number, apply for a value -added tax and pay the VAT received from the buyer from the buyer.

In many European countries/regions, you can register online through the website of tax institutions to register online. Usually, the website provides an online registry, or the PDF form that can be downloaded. You can fill in and return to the post. After you submit the application for the VAT number, you may also receive a form sent to you with ordinary mail to sign and return.

There may be related compliance requirements for applying for VAT, including the need to declare and issue a VAT invoice.

Question 2: In different European countries, what kind of tax rate should be charged at a rate of value -added tax?

For the current value -added tax rate of specified goods in specific European countries/regions, the most reliable source of information is the VAT levy institution in the country/region. You may need tax consultants to help you determine the applicable value -added tax rate.

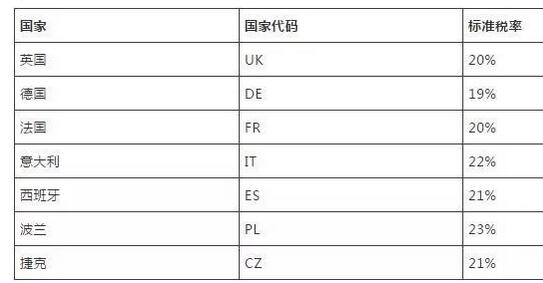

Here we have compiled the standard tax rate of EU7 for you for reference only. Specifically, whether you apply the standard tax rate, please consult your tax consultant.

Question 3: What information is needed to issue European VAT invoices?

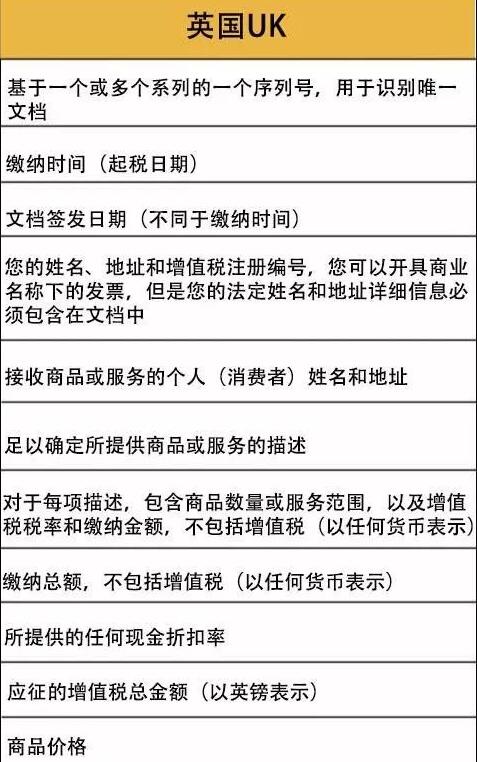

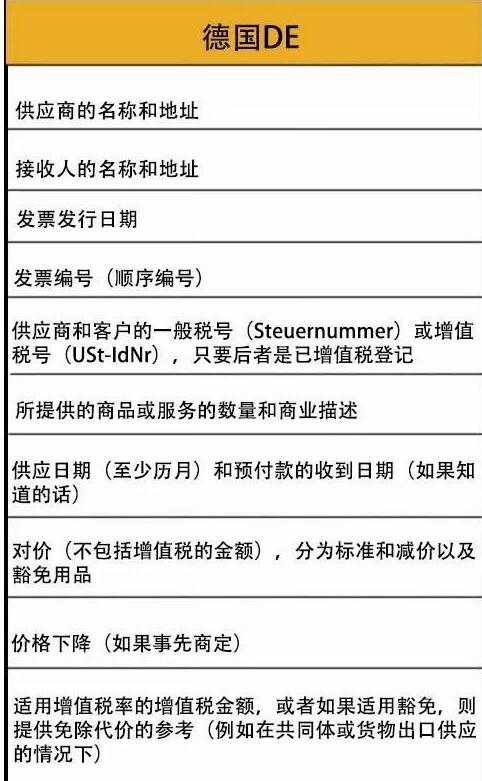

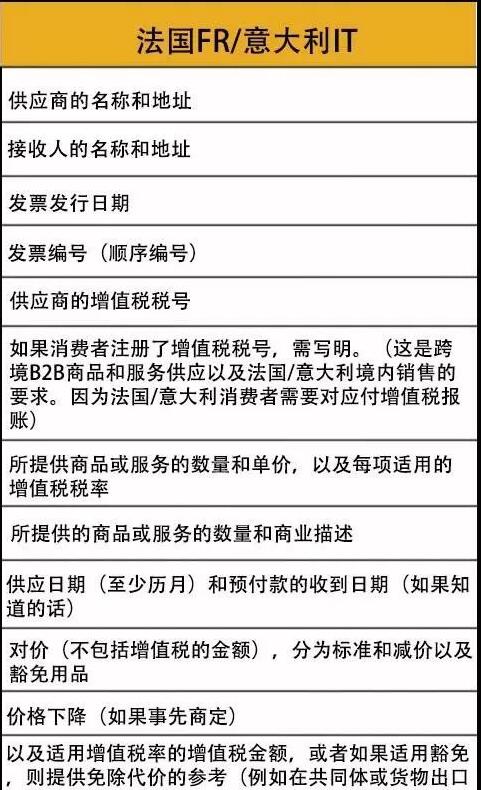

In many European countries/regions, buyers are required to issue VAT invoices. Value -added tax regulations of the country/region you shipped and the country where the buyer are located may require you to provide a VAT invoice, and the expectations of buyers usually exceed the law. For example, in Germany and Italy, high -value goods, buyers generally expect sellers to issue invoices. In the following form, you can see the requirements of four countries such as UK/DE/FR/IT to include information on invoices.

\u0026 nbsp;