The problem that has been hot recently is IEN's problem. This involves the key to cost, which suddenly increases a lot of investment in the seller. Then we will tell you today what IEN and EORI are.

What is Ien?

(Import Entry Number) referred to as IEN, the IEN number in the UK is H2 \u0026 AMP; E2 \u0026 Amp; C88, generally uses a dock code+7-bit encoding+date, for example: 071-066808T-28/11/11/11/11/11/11/11/11/11/11/11/11/11/11/11/11/11/11/11/11/11/11 2019. When commodities were imported to the European Union, the EU Customs Authorities allocated imported entry numbers for them ( Ien ). When your goods enter the European Union and declare to the customs authorities, the goods will be assigned Ien . Ien was issued to the customs applicant, and it may be your logistics agent or freight agent. If you use a freight agent, they can contact you to send Ien . There may be situations where there is no distribution of goods ien or you may not be able to obtain these goods. When imported goods, please be with your logistics provider/carrier or customs authorities

FHDDS is a legal requirement for Britain. For non -EU native products stored by non -EU sellers, all British distribution business is for all British distribution business The operator stipulates the requirements for registration, due diligence, and record retention requirements. As an operator of the Amazon British Operation Center, Amazon British Service Co., Ltd. (Amazon UK) has been approved by HMRC (General Administration of Customs) to collect the import entry number (IEN) to send goods to the British warehouse, requiring all Amazon Logistics (FBA) service All meet the rules of FHDDS.

From April 1, 2019, Amazon will follow the legal requirements and fulfill FHDDS (Fulfilment House Diligence Scheme), and will send an email notification to the seller:

Inform the seller to provide IEN to Amazon for all the goods imported from the Non -EU in the British warehouse, unless these goods have been exempted, they do not need to provide IEN.

Otherwise, if Amazon knows or has reasonable reasons to suspect that the seller does not fulfill the VAT or tariff obligation, the seller may inform the British Tax Customs Department (HMRC) or stop providing FBA services to the seller.

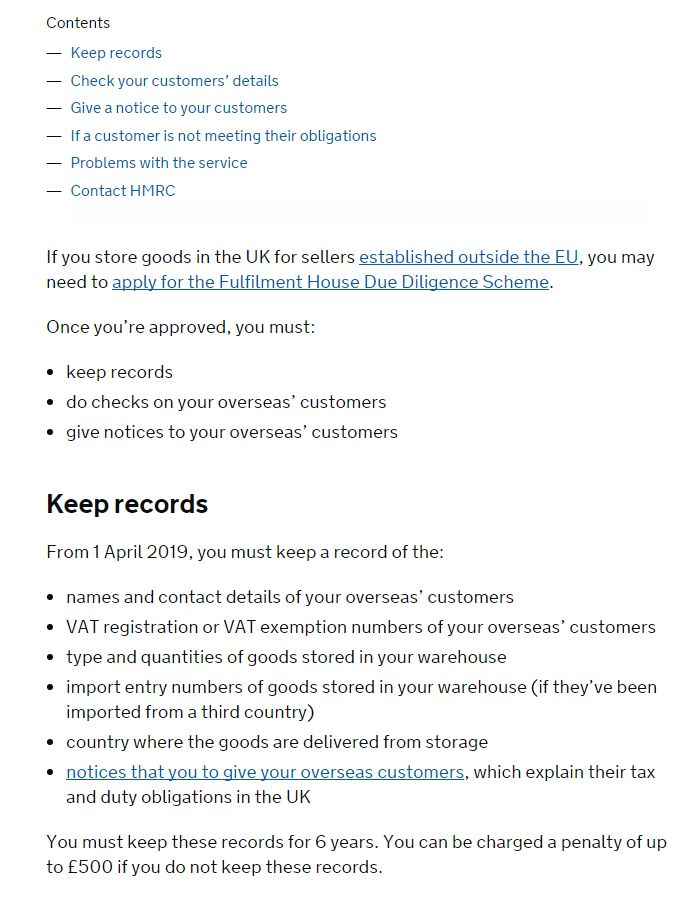

If you store goods for non -EU sellers in the UK, in accordance with the FHDDS regulations implemented in the UK, from April 1, 2019,The following records must be saved:

1. Names and contact information of overseas customers

2. VAT registration number or tax exemption number of overseas customers

3. Stored in the warehouse warehouse The type and quantity of the goods

4. The import entrance number of the cargo stored in the warehouse (if it is imported from the third country)

5. The country delivered from the warehouse

] 6. Inform overseas customers to explain their tax obligations in the UK

Note: These records must be preserved for 6 years. If these records are not kept, it will be fined up to 500 pounds.

Reminder: The seller's use of his EORI number and VAT number is a compliance approach.

Import entry coding (i ) What is it? The EU's Ien does not follow standard numbers and/or letter formats. Ien It may be distributed by different EU customs agencies, depending on the import method. On the customs documents, IEN can be identified as \"import number\", \"entry number\" or \"customs order number\". Any import entry number Amazon will provide (i Amazon needs to retain any of the products stored through Amazon logistics and imported from the EU, Amazon ]record of. The British Tax Customs Department may ask us to share any records Ien . If you cannot obtain the import entry number of some or all of the goods (i en ),,), What should I do? If you do not have a cargo IEN, you do not need to enter a IEN . If you want to inform us, you should confirm that you do not have Ien on the \"Shipment processing progress\" page of the seller platform. Letter of detailsFor interest, see \"Where can I enter the import entry code (Ien) ?\" On this page.

How long does it take to enter the import entry number (IEN)? After creating the cargo, you have 240 days to go to the goods processing progress page of the seller platform's cargo processing progress page Add the correlation of the goods you received (if you have received it). After 240 days from the date of the creation of the own goods, the IEN state will be displayed as closed and waiting for editing. At present, you can still view your IEN entry, but you can't edit it again. How to choose the logistics channel in the first stage? Many buyers are now accustomed On the logistics end. Ien's real time, most buyers do not know how to choose logistics channels. In fact, the difference between the dual -clearing tax and non -tax -inclusive channels is the control of tariffs. Most of the logistics agents in the market now also have channels that are not tax -free. You only need to choose Shuangqing without tax. British imports only need to provide VAT that can be imported normally regardless of any channels. Can reduce the risk of imports of Amazon sellers. As for the problem of tariff control, you can query the British import tariff rate of your own products, and appropriate declaration can be appropriately declared. 下面是欧洲Duty查询链接:http://ec.europa.eu/taxation_customs/dds2/taric/taric_consultation.jsp目前,在In the case of unblocked Brexit, the business license of an enterprise can only have one EORI number