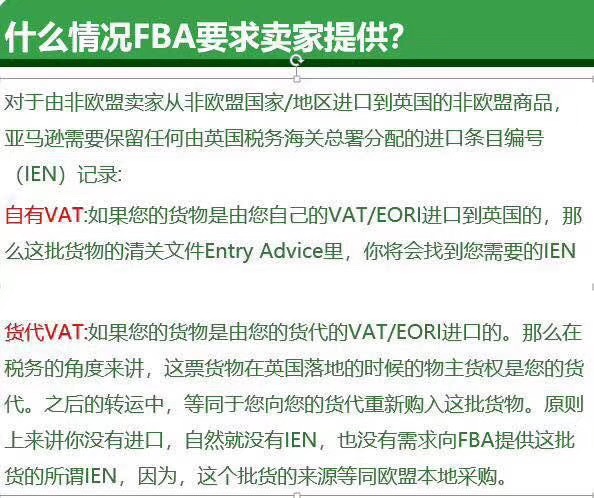

When the goods imported to the EU, the EU Customs Authorities allocated imported entries (IEN). When your goods entered the EU and declared to the customs authorities, the goods will be assigned to an IEN. Ien is to the customs to the customs The applicant may be your logistics agent or freight agent. If you use a freight agent, they can contact you to send IEN, and there may be a situation that there may not be IEN or you may not be able to obtain these goods. When imported goods, please verify with your logistics provider/carrier or customs authorities.

This policy is based on the legal requirements of the UK to ensure that the seller fulfills the British VAT and customs obligations related to imported goods. Performing the relevant obligations and still failing to fulfill it after 60 days, then Amazon has the obligation to stop providing distribution services to your products. Failure to obey these obligations may lead to a fine of 3,000 for each failure of each performance and may cause Amazon's license to be revoked.

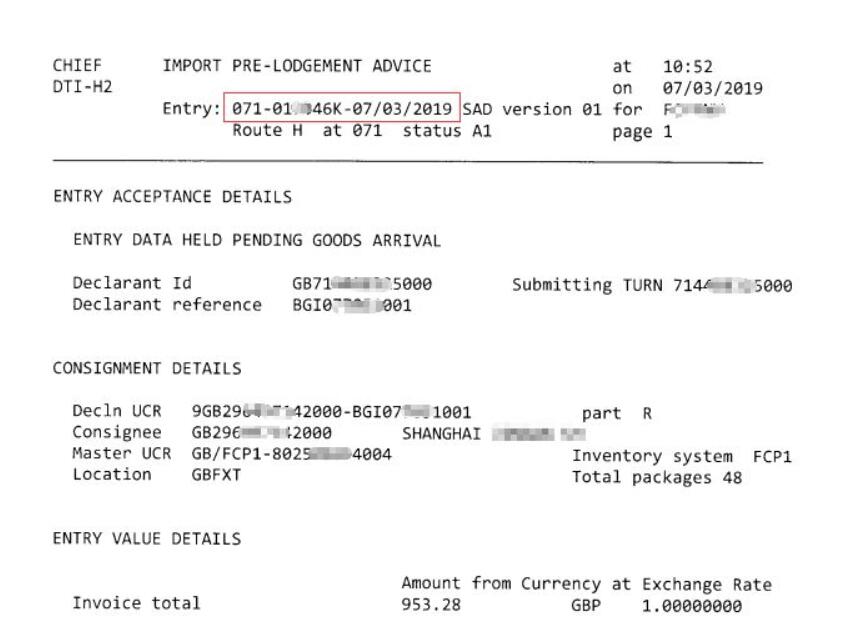

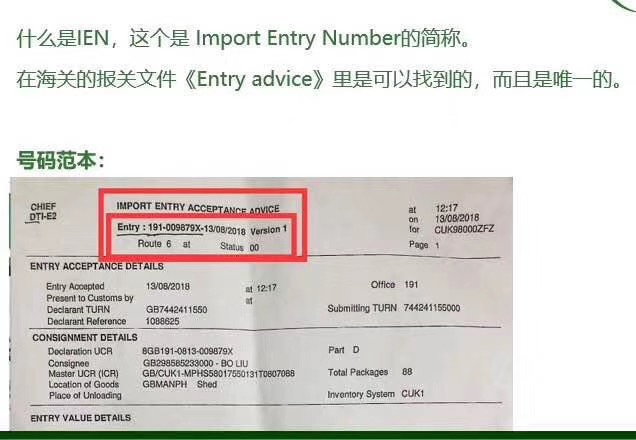

IEN number (IMPORT ENTRY Number) is the declaration number of E2 \u0026 AMP; C88, which is generally displayed in the dock code+7 -bit encoding+date. For example, 071-066808T-28/11/2018.

\u0026 nbsp;

Amazon official said :

Amazon official said :

From April 1, 2019, Amazon will follow the legal requirements and fulfill the warehousing service operator's dedication to the investigation plan (FHDDS), which means that our award -notch non -EU seller collects import entries to send goods to the British warehouse ( IEN). Amazon will send an email notice to these sellers, and if you know or have reasonable reasons to suspect that the seller does not comply with VAT or tariff obligations, Amazon may need to inform the relevant taxation department.

The seller will be required to provide IEN for all non -EU originates to all non -EU origin in the British warehouse, unless these goods have been exempted. If Amazon knows or has reasonable reasons to suspect that the seller does not fulfill its VAT or tariff obligations, the seller may inform the British Tax Customs Department.

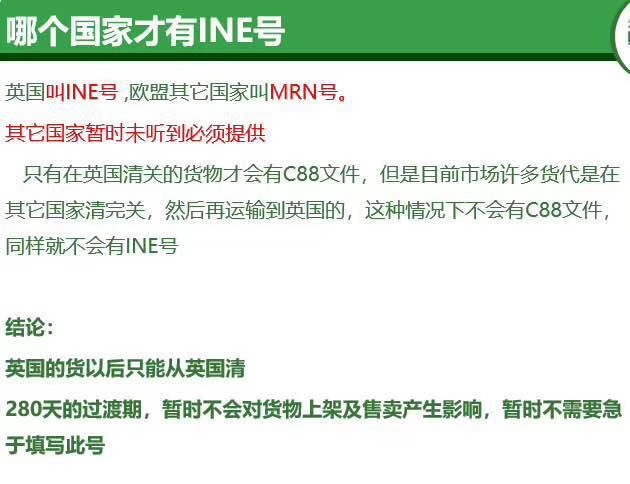

Where can I enter my import entry number (IEN)? From April 1, 2019, you will be able \"Status's goods and the goods created on April 1, 2019 or after the cargo input IEN. You do not need to provide the details of the \"closed\", \"delete\" or \"cancel\" state, and the details of the goods created before April 1, 2019. On the cargo processing progress page of the seller platform, you will see the IEN status next to each cargo that must follow FHDDS, indicating whether the IEN entry is complete, incomplete or closed for editing. You can click the IEN state to open a text box, you can enter the IEN corresponding to the goods or indicate that you have no cargo IEN. After saving your IEN entry, IEN status will be displayed.

How long does it take to enter the import entry number (IEN)? After creating the cargo, you have 240 days to go to the progress of the cargo processing progress of the seller's platform, add you to add the you received The related IEN (as you have received). After 240 days from the date of the creation of the self -goods parts, the IEN state will be displayed as closed and waiting for editing. At present, you can still view your IEN entry, but you can't edit it again.

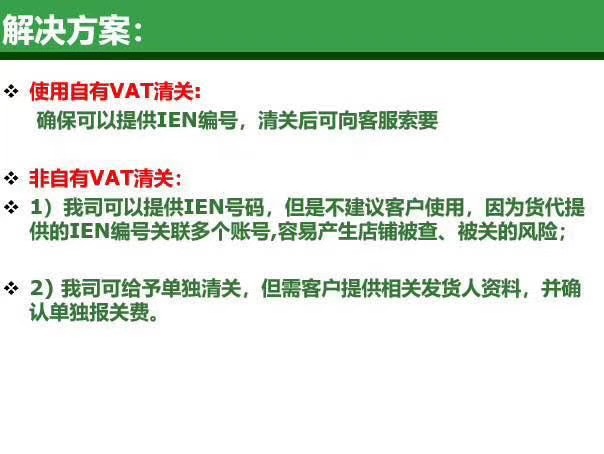

] Can the freight generation be submitted to VAT? Each cargo can actually submit IEN. However, VAT is their own VAT, not to the number, and after submitting, their VAT will also have problems, so generally unwilling to provide