According to relevant reports, Amazon provided a stock exchange agreement with Netease at the end of 2018, but the agreement has not yet been finalized. So what is the Amazon China market? Will it really be sitting in the acquisition? We wait and see

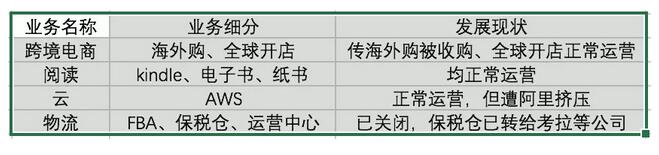

Since the acquisition of excellence in 2004, Amazon has been working hard for nearly 15 years. This is not the first time that Amazon has been rumored to sell Chinese business . Earlier, LeTV and Halo New Networks both had the acquisition of scandals, although these rumors were largely misunderstood and even the buyer's \"hype\". The response given by Amazon China this time is still \"rumors\", but this does not cover its loneliness in the Chinese market today. Overseas purchase and sale is just a microcosm of its Chinese business defeat: except for reading business, it is still strong, and other Amazon other businesses are not in other businesses. Be successful.

Simply put, it is not convinced of soil and water. 123].

In China, Amazon also established a foothold on the earliest bank (that is, selling books on e -commerce platforms). At that time, its biggest opponent was Dangdang. In this single category competition, Amazon became the winner with its accumulated supply chain, logistics advantages and assistance of local allies.

But the book is not sold well, and Amazon needs to seek greater development in the Chinese market. However, because of its successful confidence in the success of the book category at that time, he wanted to directly copy the previous supply chain and logistics experience without conducting a full research on the Chinese market, and was eventually sniped by local e -commerce.

It is different from Amazon's positioning to the mid -to -high -end. It adheres to the inherent \"tall\" play. Local e -commerce has entered the game from the beginning, focusing on low -cost strategies, and quickly occupy the market. Amazon's dishonation . To make matters worse, under the general trend of consumption upgrade in recent years, Amazon, which focuses on the mid -to -high -end market, still has not caught up. Local e -commerce is very familiar with the Chinese market environment, and its strategy is very flexible. In addition to the price war, it has also played offline warfare, marketing war, and creating new formats. For example, a selection of e -commerce companies that launch a lifestyle such as Taobao heart selection and NetEase strict selection.

Amazon needs NetEase

Amazon's e -commerce business in the United States and other developed markets is not much. Essence This is why it actively expands to high -growth markets such as Southeast Asia and India.

Amazon often believes that India is the most promising market.In 2016, it promised to invest $ 5 billion in India, including joint venture, infrastructure upgrades, and original digital content in the Indian market. According to Citi Research, this expansion has helped it control about 30 % of the Indian e -commerce market.

However, the Indian government recently launched a new e -commerce platform policy, which may destroy Amazon's plan. New laws are prohibited from providing exclusive sales of online retailers, prohibiting them from selling products they own equity, restricting discounts and cashback offers, and restricting foreign direct investment in local retailers.

Amazon protested against the new rules, but it obviously still needs to pay attention to other growth markets other than India. China has been ignored in Amazon in the past 15 years. In the Chinese market that is currently based, it still needs to rely on a local partner to expand its share.

The competition between Amazon and Alibaba's Tmall or JD.com will be hit with eggs. Many companies have not been able to shake the status of these two companies before. At present, there are still a lot of fighting. Amazon launched Prime in China three years ago, but it did not have a lot of digital content support like the United States.

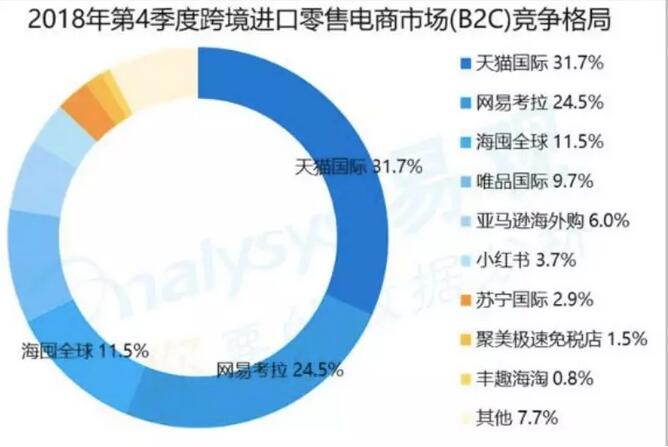

Therefore, Amazon is more meaningful to focus on smaller cross -border import markets. The merger of Amazon's import business with Netease can help it quickly make progress in this smaller market.

Netease also needs Amazon

Most of NetEase's income comes from online video games. More than a quarter of their income came from two e -commerce platforms Koala and Yanxuan.

Netease's e -commerce business is the fastest growing department in recent quarters. However, the department's operating profit margin (10 % in the third quarter) is still far lower than the operating profit margin of more than 60 % of its online games and advertising business.

There are still many controversy in NetEase's strict selection, because the products it sells is the same product produced by the brand in domestic manufacturers, but it is not well -behaved. But the price is much lower.

These products are not technically imitation products, but the plagiarism on the design has brought great risks to the future of Yan Xuan. Last year, Pinduoduo was hit by the government for similar products.